The spread and response to COVID-19 has taken nearly all the time and attention of almost everyone. For companies trying to navigate the extreme uncertainty and high risks associated with collapsing supply and demand, there is little ability to manage anything else.

But the US-China trade war continues to grind on. While coronavirus takes the headlines, the economic damage from more than two years of trade hostilities between the two largest global economies continues to take a toll. Worse, US President Donald Trump appears eager to escalate the fight all over again for the rest of this year.

Many people seemed to have stopped paying attention the trade conflict back when the Phase 1 “deal” was signed in January and implemented on February 14 (both dates seem like a lifetime ago already!).

As we noted at the time, the Phase 1 deal was never likely to hold. The agreement had promises in a variety of areas from intellectual property rights to financial services. But the most important element was a promise to purchase goods. The US insisted that China buy $200 billion in products ranging from soybeans to energy in a two-year time frame.

This target was never realistic. It was nearly double any previous purchases made by China for US exports and it was coming off extremely low export figures across the duration of US-China tariff escalation. The chart below, from CFR’s Brad Setser, shows the size of the challenge.

The Phase 1 deal arrived just as the COVID-19 situation was taking off in China. With factories and shops shuttered across the country (and not just in Wuhan at the epicenter), Chinese imports from everywhere sagged.

Meeting the series of purchasing targets went from impossible to never-going-to-happen.

So what was the appropriate US response? There were two options available to Washington. First, to acknowledge that the scale and depth of the crisis made previous commitments unattainable in the short term and either recalibrate the expectations, adjust the target levels, or shift the timeline.

Second, to complain loudly that China had failed to meet the purchasing targets and start the whole conflict all over again.

Trump has just selected option two, making repeated statements about his intention to return to the height of the US-China trade conflict. This could include canceling the entire Phase 1 agreement or escalating tariffs again.

Before reflecting on what an escalation of tariffs might look like, it is worth noting the extent to which tariffs remain in place between the two sides after the Phase 1 deal took effect.

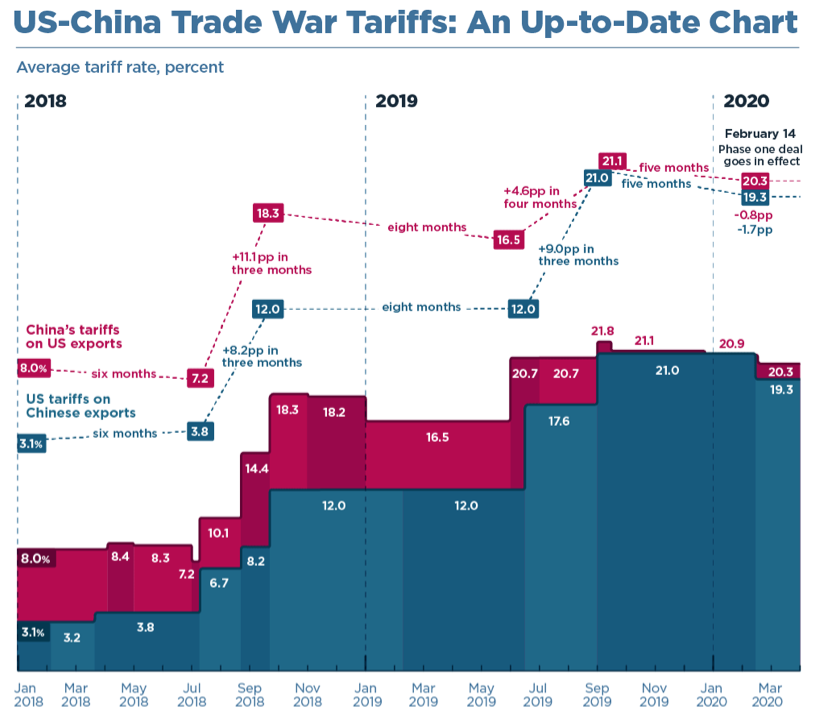

As the following chart from the Peterson Institute for International Economics shows, heading into the trade conflict in early 2018, average tariff rates for imports from the US to China were 8% (and even declined by July 2018) while average tariffs for imports to the US from China were 3.1%.

Even after the Phase 1 deal, average tariff rates into China soared to 20.3% while the US tariffs on Chinese goods reached 19.3%. The amount of merchandise trade covered under these tariffs also remained substantial, with additional US-China trade war tariffs slapped on American imports of products worth US$370 billion.

There has been a strong and active lobbying campaign in the US to get many of these tariffs removed. Many firms had received exemptions from tariffs over the course of the conflict. These exemptions have now been largely extended, but the value of traded products covered by significantly increased tariff costs is still high.

In spite of a collapsing global economy and trade flows projected to be -13 to -32%, President Trump has waded into this fragile and uncertain situation armed with the same toolkit he has used in the past. His toolbox contains basically an assortment of hammers and sledgehammers.

His latest response to global trade uncertainty is to threaten to cancel the Phase 1 agreement and impose new tariffs. In addition, US Commerce Secretary Wilbur Ross (remember him?) has just started the fifth US Section 232 case.

Why? Partly because the toolbox only contains hammers, of course, leaving these instruments as the available tools of choice. But also because Trump clearly believes that trade remains a winning strategy for him heading into November.

Given the obvious strains in the US economy, he will struggle to show positive economic results to voters in the rest of his term in office. The clear solution is to return to what he believes works—showing toughness in trade, especially with the biggest adversary. Bashing China is an electoral strategy that he believes will work for November.

The Phase 1 deal was written with a fairly simple exit strategy. Slightly oversimplified, the US was responsible for deciding if China lived up to its commitments. If China did not, the US reserved the right to cancel it. Ending the Phase 1 agreement also means that future tariff escalations can be back on the table.

Firms may uneasily recall that planned tariff increases of 10% on the items in List 4 were suspended. Since List 4 includes every item shipped from China to the US, this is a significant challenge.

Many may argue that now, more than ever, firms should simply be getting out of China and returning to the US. Hence, if it takes rising tariff bills to make it happen, this is a price worth paying.

For firms, moving supply chains and sourcing is much more complicated that it seems to outsiders. There are lots of reasons why firms manufacture and import goods from China in the first place and many of these advantages have not stopped.

If the US proceeds with the latest threats to increase tariffs again on Chinese goods, the net result is going to be even greater disruption to trade at a time when the global economy can ill afford new sources of uncertainty.

Many firms may make choices that are not anticipated, including abandoning the US market and focusing instead on Asia or Europe. Business, at the end of the day, may very well opt to deliver goods and services to places with lower risks.

***This Talking Trade was written by a not surprised, but still disappointed, Dr. Deborah Elms, Asian Trade Centre, Singapore. If you want help thinking through your supply chain and sourcing options, please contact us today at info@asiantradecentre.org***